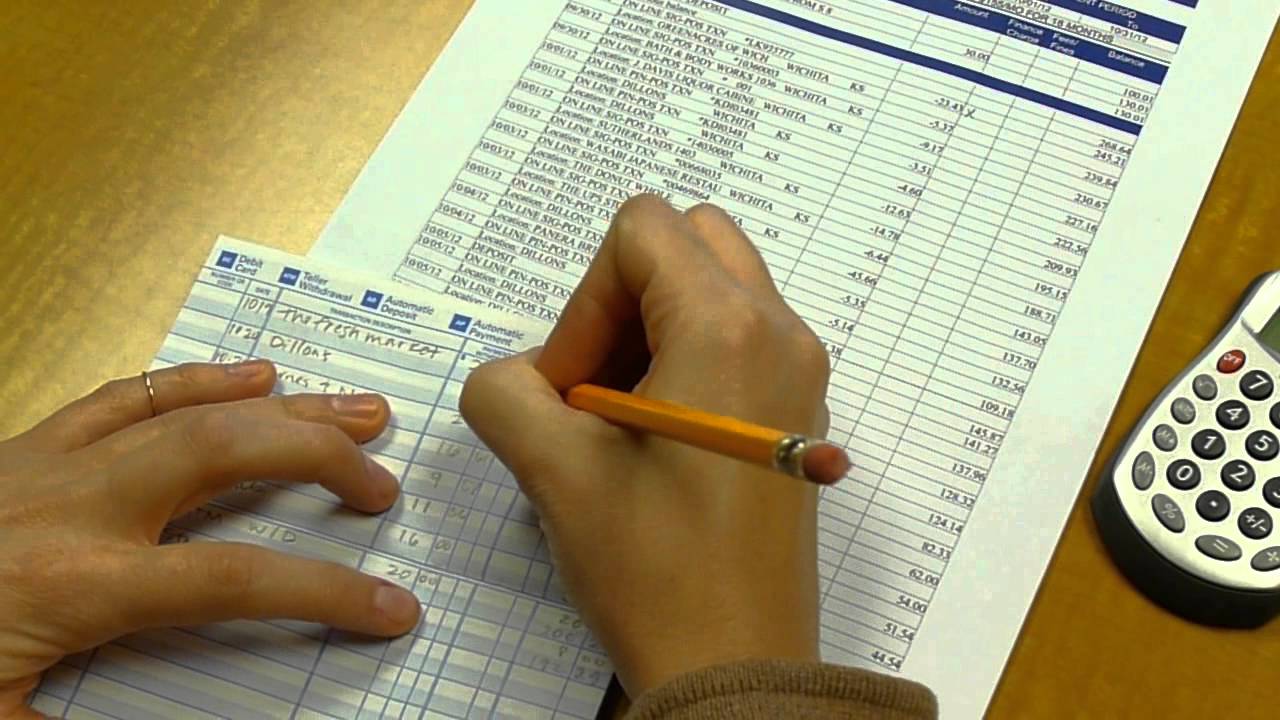

Tip: Use the worksheet on the back of your statement. Make a list of any deposits that are listed in your register but do not appear on your statement. Look at your latest statement and verify that all deposits listed match the deposit amounts listed in your checkbook register. Subtract these charges from your register balance. In your checkbook register, record any charges that have been subtracted from your account, as shown on your statement. Be sure to record any other credit amounts listed, such as corrections by the institution. The interest earned will appear on the front of your statement.Īdd this balance. In your checkbook register, enter all of the interest earned on your account (if applicable). Any ATM and/or Visa CheckCard Receipts that you did not record in your checkbook register.Use it along with the following steps to make balancing a snap.

On the back of your monthly statement is a handy form to help you balance. And, if for some reason you detect a problem, the sooner you can correct it, the better.īalancing your checkbook each month within a day or two of receiving your statement will not only reduce your stress level, it will lessen the amount of time it takes to complete the task. It’s important to record the transaction at the time you actually write the check, make a withdrawal, or make a deposit.īy recording the transactions and balancing your account total in your checkbook register, you’ll get a clearer picture of your spending habits and know exactly how much money you have. Recording each transaction in your checkbook register and adding or subtracting it from the balance is the first step to simplifying the balancing act. Remember, it also takes a few days for your checks, ATM/MasterCard, and/or deposit transactions to be recorded on your account.

Meanwhile, you are continuing to write checks, make ATM withdrawals and/or deposits, and hopefully, keeping track of these transactions in your checkbook register. Once your statement has closed, it will take a few days for the information to be printed and for it to arrive in the mail.

The closing date is usually found in the upper right-hand corner of the first page of your statement. Your statement lists the transactions posted to or cleared to your account as of the closing date. Seldom will your statement and checkbook register agree. This brochure will help simplify the balancing process and hopefully reduce the anxiety level when your statement arrives.

0 kommentar(er)

0 kommentar(er)